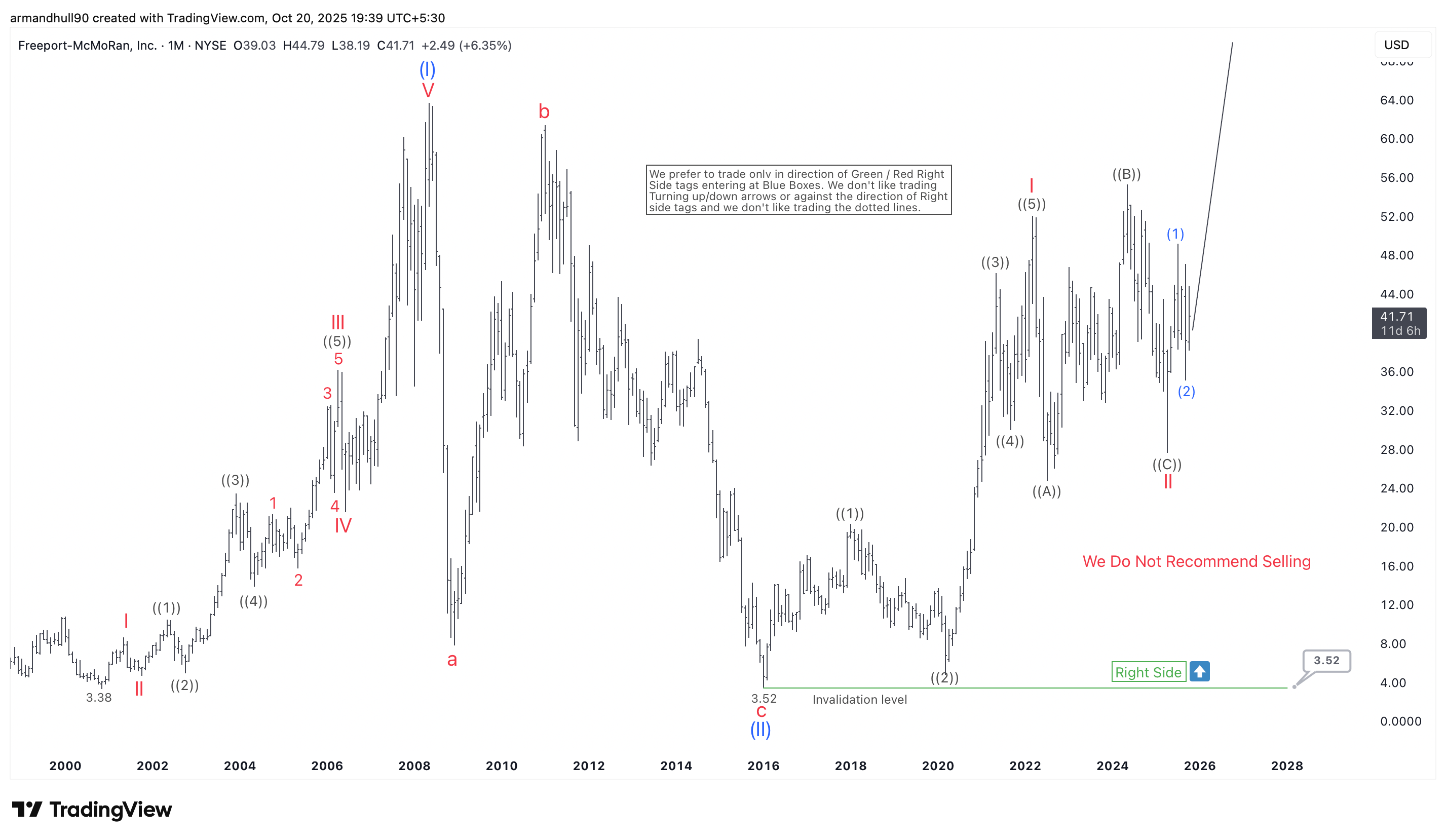

Elliott Wave construction of Freeport-McMoRan (NYSE: FCX) suggests the completion of a significant correction and the start of a brand new bullish cycle, supported by rising international copper demand and robust market momentum.

Freeport-McMoRan Inc. (NYSE: FCX), one of many world’s main copper producers, continues to show a robust bullish construction in the long run. In line with the Elliott Wave evaluation, the inventory has doubtless accomplished a significant correction and began a brand new upward impulse inside wave III.

The Lengthy-Time period Elliott Wave Construction:

The primary vital rally started from the 2000 low close to $3.38. It unfolded in a transparent five-wave impulse, finishing wave (I) on the 2008 peak. The 2008–2009 monetary disaster then triggered a steep drop, forming wave (II). From there, FCX entered a robust restoration that ended round $61.34 in early 2022, marking the top of a higher-degree wave I in blue.

Following this rally, the decline from 2022 to 2025 unfolded in a corrective sample ((A))–((B))–((C)), which bottomed close to $30. This decline accomplished wave II in purple. The sturdy rebound that adopted suggests the start of wave (3) of III, usually probably the most highly effective a part of an Elliott Wave sequence.

The invalidation degree for this bullish construction stands at $3.52, the 2016 low the place wave (II) ended. So long as FCX stays above that degree, the suitable facet of the market stays bullish. Moreover, rising international demand for copper, pushed by electrification and renewable power, helps the long-term outlook.

From an Elliott Wave perspective, wave (3) might lengthen to new highs and past the $60–$65 zone within the coming years. The inventory is positioned properly for potential positive aspects if the bullish momentum continues.

Abstract:

In abstract, Freeport-McMoRan (FCX) maintains a robust bullish construction above $3.52. Merchants and buyers might proceed to favor the upside because the commodity supercycle and copper demand growth stay supportive.