A Decisive Bullish Offensive: FIIs Unleash Excessive-Conviction Shopping for in Financial institution Nifty

In a shocking and highly effective show of conviction, Overseas Institutional Traders (FIIs) have simply despatched their most unambiguously bullish sign in current reminiscence. On October 24, 2025, FIIs had been large web consumers within the Financial institution Nifty Index Futures, buying a colossal 6,008 contracts with a notional worth of ₹1,230 crores.

Nonetheless, essentially the most crucial a part of this story—and what makes it a game-changer—is that this large shopping for was accompanied by a important web open curiosity (OI) improve of 4,422 contracts. That is the irrefutable and textbook signature of new, aggressive lengthy positions being constructed.

The Sign is Clear: That is New Bullish Conviction, Not a Squeeze

For weeks, we’ve got meticulously distinguished between misleading short-covering rallies (shopping for with a fall in OI) and real power. Right this moment’s motion is the latter, and its sign is crystal clear. This isn’t the sound of bears exiting the market; it’s the sound of bulls coming into the battlefield with overwhelming power.

When FIIs purchase and OI will increase, it means they’re deploying recent institutional capital to make new, leveraged bets on a future rise in costs. This isn’t a tactical retreat to lock in income on outdated shorts; it’s a strategic advance, signaling a basic and optimistic change of their outlook on the banking sector.

Key Implications for Merchants:

-

A Basic Change in Market Character: The market’s character has now decisively shifted. The earlier dominant theme of “promote on rise” has been invalidated. With a big block of recent institutional longs established, the market is extremely prone to shift to a “purchase on dips” mentality, as FIIs can be incentivized to defend their new, high-conviction positions.

-

Creation of a Highly effective Help Base: The value ranges at which this heavy shopping for occurred have now grow to be a formidable assist zone. The market is unlikely to simply break under this space, as it could imply placing these 1000’s of recent institutional positions into the purple.

-

Gas for a Sustainable Advance: Not like a fragile, technically-driven short-covering rally, a value advance constructed on the muse of recent lengthy positions is structurally sound and highly effective. It has the backing of recent, optimistic capital and has a a lot greater chance of being sustained over time.

Conclusion:

The info from October twenty fourth is a game-changer for the Financial institution Nifty and the market as an entire. After an extended interval of bearish positioning and tactical maneuvers, the FIIs have lastly proven their hand with a high-conviction, offensive bullish transfer. The initiation of 1000’s of recent lengthy contracts is a robust sign that can’t be ignored. Whereas at some point doesn’t make a pattern, a transfer of this magnitude is a transparent declaration of intent. Merchants ought to now deal with any quick positions with excessive warning, as the trail of least resistance has decisively and powerfully shifted to the upside. The sensible cash has spoken, and their message is unequivocally bullish.

Final Evaluation will be learn right here

The Financial institution Nifty is presently at a crucial and high-stakes inflection level. After a robust show of power, the index has paused to consolidate, making a basic setup for a major enlargement in volatility. The value motion, mixed with a serious upcoming timing sign, suggests {that a} highly effective, directional transfer is imminent, and the important thing lies in watching the banking heavyweights.

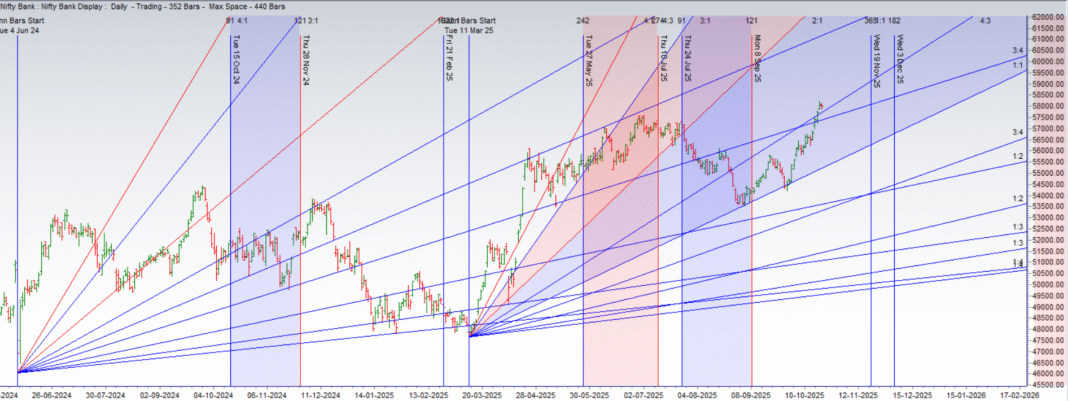

The Bullish Basis: A Confirmed Breakout Above the Gann Angle

First, it’s essential to acknowledge the underlying power out there’s construction. The Financial institution Nifty has efficiently achieved a shut above the important thing 4×3 Gann Angle. This can be a important technical victory for the bulls. Conquering a Gann angle of this significance is just not a minor occasion; it signifies {that a} earlier line of resistance has now been transformed into a brand new and highly effective ground of assist. This breakout offers the bullish basis for the market’s subsequent potential up-leg.

The Consolidation Section: The Inside Bar and the Solar Ingress

Regardless of this highly effective breakout, the bulls had been unable to carry onto their preliminary gap-up positive aspects, a growth we anticipated as a result of affect of the Solar’s ingress into Scorpio. This highly effective astrological occasion usually brings a few shift in vitality, resulting in profit-taking and consolidation.

The market’s response was textbook: it digested the current positive aspects and shaped a basic Inside Bar yesterday. An Inside Bar represents a contraction of volatility and a interval of equilibrium—an ideal stalemate between consumers and sellers. That is the market catching its breath and coiling like a spring after a major transfer.

The Imminent Catalyst: Bayer Rule 15 Alerts a “Main Transfer”

This state of equilibrium is about to be shattered. Right this moment, a serious and traditionally important timing sign turns into energetic:

Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES

Because the rule itself states, it is a recognized catalyst for initiating “MAJOR MOVES.” When such a robust timing rule aligns with a value sample of maximum consolidation (the Inside Bar), it’s a high-probability sign that the interval of quiet is over and a major, directional value swing is about to start. The truth that the weekly expiry is simply two days away provides one other layer of urgency, as it’s going to power the decision of choices positions and might amplify the ensuing transfer.

The Inform: Watch HDFC Financial institution and ICICI Financial institution

On this high-stakes atmosphere, we should watch the lead indicators. As Venus-ruled shares, the efficiency of the 2 index titans, HDFC Financial institution and ICICI Financial institution, would be the final “inform.” They are going to be most delicate to the energies of Bayer Rule 15 and can seemingly lead the Financial institution Nifty’s subsequent transfer.

-

Power in HDFC and ICICI will sign that the Bayer Rule is resolving to the upside, seemingly triggering a robust breakout from the Inside Bar and a continuation of the rally.

-

Weak spot in HDFC and ICICI will point out that the rule is triggering a reversal, turning yesterday’s consolidation right into a distribution sample earlier than a transfer decrease.

Conclusion:

The Financial institution Nifty has given us an ideal setup: a confirmed bullish breakout, adopted by a textbook consolidation sample, all occurring simply as a serious timing rule for a “huge transfer” turns into energetic. The indecision of the Inside Bar is about to be resolved with power. All eyes ought to now be on HDFC Financial institution and ICICI Financial institution, as their route would be the key to unlocking the Financial institution Nifty’s subsequent main pattern. Put together for a major enlargement in volatility.