A Decisive Shift: FIIs Unleash a Excessive-Conviction Bullish Offensive in Financial institution Nifty

In a dramatic and highly effective shift from their latest habits, Overseas Institutional Buyers (FIIs) have simply despatched their most unambiguously bullish sign in weeks. On October 16, 2025, FIIs have been large web consumers within the Financial institution Nifty Index Futures, buying 4,200 contracts with a colossal notional worth of ₹843 crores.

Nevertheless, for the primary time in an extended whereas, probably the most essential a part of the story is just not considered one of quick overlaying. The secret is that this large shopping for was accompanied by a vital web open curiosity (OI) improve of two,760 contracts. That is the irrefutable signature of new, aggressive lengthy positions being constructed.

The Sign is Clear: That is New Bullish Conviction

For weeks, we’ve got highlighted how FII shopping for accompanied by a lower in OI was a misleading signal of quick overlaying. Right now’s motion is the polar reverse and should be handled with the utmost seriousness. This isn’t the sound of bears exiting the market; it’s the sound of bulls coming into the battlefield.

When FIIs purchase and OI will increase, it means they’re deploying contemporary capital to make new, leveraged bets on a future rise in costs. This isn’t a tactical retreat to lock in earnings; it’s a strategic advance, signaling a elementary change of their outlook on the banking sector.

Key Implications for Merchants:

-

A Elementary Change in Character: The market’s character has now modified. The earlier dominant theme of “promote on rise” is now being straight challenged. With a big block of recent institutional longs established, the market is more likely to shift to a “purchase on dips” mentality, as FIIs shall be incentivized to defend their new positions.

-

Creation of a Highly effective Help Base: The worth ranges at which this heavy shopping for occurred now turn out to be a formidable assist zone. The market is unlikely to simply break beneath this space, as it might imply placing these new, massive institutional positions into the pink.

-

Gas for a Sustainable Advance: Not like a short-covering rally, which is technically pushed and inherently fragile, a rally constructed on the inspiration of recent lengthy positions is structurally sound. It has the backing of contemporary, optimistic capital and has a a lot larger likelihood of being sustained over time.

Conclusion:

The information from October sixteenth is a game-changer for the Financial institution Nifty. After an extended interval of bearish positioning and tactical profit-taking, the FIIs have lastly proven their hand with a high-conviction, offensive bullish transfer. The initiation of hundreds of recent lengthy contracts is a strong sign that shouldn’t be ignored. Whereas someday doesn’t make a development, a transfer of this magnitude is a transparent indication that the institutional sentiment is popping constructive. Merchants ought to now deal with any quick positions with excessive warning, as the trail of least resistance has decisively shifted to the upside. The good cash has spoken, and their message is unequivocally bullish.

Final Evaluation might be learn right here

The Financial institution Nifty is at present at a essential and exhilarating juncture, the place a strong, technically-driven rally is now difficult the ultimate vital barrier that stands between it and a brand new all-time excessive. The transfer, which started from a exactly timed backside, has now entered a key resistance zone that would be the final check of the bulls’ conviction forward of the essential weekly shut.

The Basis: A Excellent Backside Name by Bayer Rule 6

First, it’s important to grasp that the latest highly effective rally was not a random or stunning occasion for followers of cycle evaluation. As mentioned in our latest video, the market registered a significant backside in good alignment with Bayer Rule 6, which states:

“The worth is in backside when Mars was in 16 levels 35 minutes of some signal and plus 30 levels.”

This highly effective rule supplied the temporal and mathematical basis for the reversal, giving merchants a high-conviction sign that the promoting strain was exhausted and a brand new up-leg was imminent. The robust advance we’ve got witnessed this week is a direct and highly effective impact of this cycle turning.

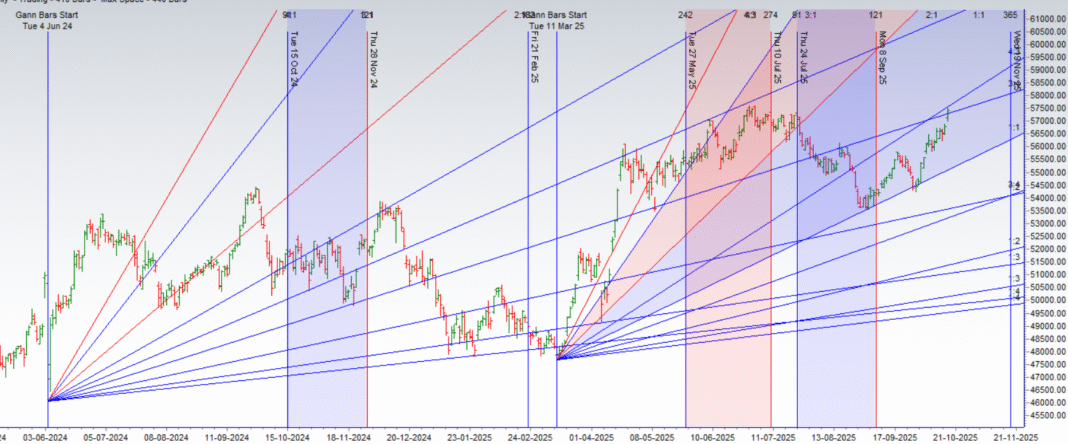

The Last Hurdle: The 4×3 Gann Angle at 57525

Having traveled a major distance from that low, the Financial institution Nifty is now coming into a formidable resistance zone. The instant and most important problem is the 4×3 Gann Angle, which is at present positioned at 57525.

In Gann evaluation, these angles signify the concord of worth and time. For a market in a strong development, breaking by way of considered one of these angles is a major technical feat that usually results in a fast acceleration. The bulls at the moment are trying to realize this breakout. A decisive shut above 57525 could be a significant victory, signaling that they’ve overcome the pure resistance and have the power to problem the final word prize.

The Final Goal: The All-Time Excessive and Mahurat Buying and selling

A profitable shut above the Gann angle opens the door for a transfer in direction of the all-time excessive of 57628. This isn’t only a technical goal; its timing is of immense psychological significance.

With tomorrow being the weekly shut, the session’s last print carries additional weight. A failure on the Gann angle could be seen as an indication of exhaustion. Nevertheless, an in depth above the angle, and particularly an in depth at or close to a brand new all-time excessive, could be probably the most highly effective assertion the bulls may presumably make.

This may create a wave of utmost optimism heading into the particular Mahurat buying and selling session on Tuesday. A market closing at its absolute peak forward of this auspicious session would create a strong, constructive suggestions loop, possible attracting contemporary capital and setting a bullish tone for the festive season and past.

Conclusion:

The market has flawlessly adopted the script, bottoming on a key Bayer Rule and rallying to a key Gann resistance. The battle strains at the moment are clearly drawn. The bulls should conquer the 57525 Gann angle to unlock a check of the all-time excessive. A weekly shut at 57628 is the “grand slam” state of affairs that would offer most constructive sentiment for the Mahurat session. The ultimate hours of buying and selling this week shall be essential in figuring out whether or not the bulls have the conviction to finish their good technical setup.