Good night, merchants and buyers.

Markets bounced once more immediately, extending Monday’s rebound and delivering a robust session throughout the board. Equities gapped increased on the open, pushed by renewed optimism after final week’s tariff shock, however as we mentioned this morning, gaps above resistance hardly ever maintain cleanly.

By mid-day, early enthusiasm pale as FOMO shopping for gave solution to one other spherical of profit-taking. The S&P 500 and Nasdaq ended constructive, however intraday motion continues to focus on a extremely emotional, back-and-forth market—one which flips from panic to greed and again inside hours.

Market Insights, Information & Financial system

Inventory Market Development

Immediately’s session was dominated by FOMO shopping for on the open, adopted by regular promoting into noon.

- The FOMO indicator broke above its higher threshold early, signaling crowd euphoria earlier than costs reversed decrease.

- On the 10-minute chart, we noticed a number of value spikes—each examined and stuffed—displaying traditional short-term exhaustion.

- The volume-by-price profile suggests a sticky vary forming just under resistance. This zone might cap upside makes an attempt for now.

Whereas the longer-term pattern stays technically inexperienced, the market’s inner energy is eroding. Our fashions present a setup much like the prior pre-correction topping section, when sensible cash rotated out whilst retail merchants saved pushing costs increased.ggest the market is near a possible pattern shift if weak spot returns later this week.

Utilities Flash One other Warning

Utilities (XLU) stay on fireplace, dramatically outperforming the broad market but once more.

This has been our main warning sign for weeks. Persistent utility management throughout a rally is a traditional defensive inform—it typically precedes a market stall or deeper correction.

Whereas utilities might quickly appropriate together with all the pieces else, their present energy reinforces the view that institutional cash is getting ready for turbulence.ons whereas persevering with to carry QQQ and XLC till their respective alerts full.

Valuable Metals Surge Once more

Gold and silver prolonged their rallies immediately, persevering with to behave because the safe-haven of alternative no matter what equities do.

- Quantity retains ramping increased as momentum patrons pile in.

- This conduct—rising quantity with rising value—confirms robust conviction, although it additionally raises capitulation threat as late patrons chase momentum.

One member requested about silver’s breakout above $50 and whether or not that triggers a brand new purchase sign.

From a pure technical and risk-management standpoint: no.

We don’t chase after parabolic strikes. In case you’re already lengthy from prior alerts, benefit from the journey and shield positive factors. However getting into recent right here can be chasing value, not buying and selling technique.

We already closed our short-term gold commerce on the measured transfer goal—completely timed on the Fibonacci peak we have been aiming for.

That was a discretionary swing, separate from long-term holdings.

Lengthy-term buyers ought to stay positioned for increased valuable metals over the approaching weeks and even months.. Momentum and pattern alignment at all times override emotion and information.

Gold, Greenback, and Correlation Myths

A number of members requested about how gold strikes relative to the U.S. greenback.

The reality: there may be no mounted relationship.

Generally each rise collectively; generally they diverge. Correlations shift with market context.

Proper now, gold and the greenback are rallying collectively—a dynamic typically seen in stress durations when buyers search liquidity and security concurrently.

That’s why we commerce value, not assumptions. Markets evolve; previous correlations don’t assure future efficiency.

Historic Analog: 2007 Comparability

Overlaying present value motion in opposition to 2007 exhibits an eerily comparable setup:

- The S&P 500 is testing highs as gold accelerates upward.

- In 2007, shares topped whereas gold continued to rise, attracting inflows from equities earlier than each ultimately reversed.

- Gold went on to achieve sharply earlier than the inventory market breakdown ultimately dragged it decrease.

We could possibly be getting into the early phases of that sample once more—with equities beginning to wobble, and valuable metals pushing towards a possible blow-off section.

Whereas the latest gold swing was short-term, I proceed to count on potential blow-off highs forward, presumably reaching $4,500–$5,000 if market stress expands.

TDividend Shares & Rotation Themes

Dividend-focused equities proceed to underperform.

The S&P 500 Excessive Dividend ETF retains stair-stepping decrease, displaying that large capital isn’t chasing yield or “blue chip security.”

As an alternative, small caps (Russell 2000) and high-beta sectors hold drawing the move.

This cut up—defensive sectors robust, speculative areas euphoric—is one other hallmark of late-stage market conduct.; the earlier 15% achieve captured within the bonus commerce was tactical and full.

Member Q&A Highlights

1. TFSA & RSP Accounts (Canada)

For members who can’t convert currencies in registered accounts:

- The DLR ETF gives a solution to achieve publicity to U.S. greenback motion inside Canadian accounts.

- DLR additionally pays small dividends and might function a momentary parking spot throughout money phases.

2. Power Sector & ERY Inverse Setup

Power has begun to crack, and ERY (inverse power ETF) is on watch.

We do have a promote sign on the final inventory market pattern, however I’m not getting into new discretionary trades but—volatility feels random, and timing isn’t very best.

If markets affirm a deeper breakdown, ERY and inverse actual property ETFs may develop into robust candidates. For now, capital safety takes precedence.

Metals: Platinum, Palladium, and GLTR

- Platinum is flagging bullishly, holding a operating correction that might break increased quickly.

- Palladium continues its explosive transfer.

- GLTR, the basket ETF of gold, silver, platinum, and palladium, has gone parabolic, with large quantity surging in latest days.

In case you maintain a number of metals positions—gold, silver, GLTR, miners—bear in mind they’re the identical commerce. They are going to rise collectively and fall collectively.

Trimming partial earnings, tightening stops, or scaling out progressively helps keep away from the emotional lure of watching all the pieces spike after which collapse without delay.

Key Takeaways

- Equities: Nonetheless risky, flipping day by day between worry and greed. Development softening.

- Utilities: Outperforming once more—clear defensive sign.

- Gold/Silver: Sturdy and prolonged; get pleasure from earnings, don’t chase.

- Greenback: Rising alongside gold—commerce what’s actual, not what “ought to” occur.

- Power: Cracking; ERY setup price monitoring.

- GLTR/Metals: Parabolic; scale out progressively to guard positive factors.

Backside Line

We’re in a transition section — emotional markets, late-stage rotation, and heightened volatility.

Valuable metals are thriving, utilities hold flashing warning, and equities are struggling to maintain momentum.

The subsequent few periods may outline whether or not that is simply consolidation or the beginning of a broader reversal.

Keep affected person, handle threat, and bear in mind: pattern affirmation beats prediction each time.

Discuss quickly, and commerce secure.

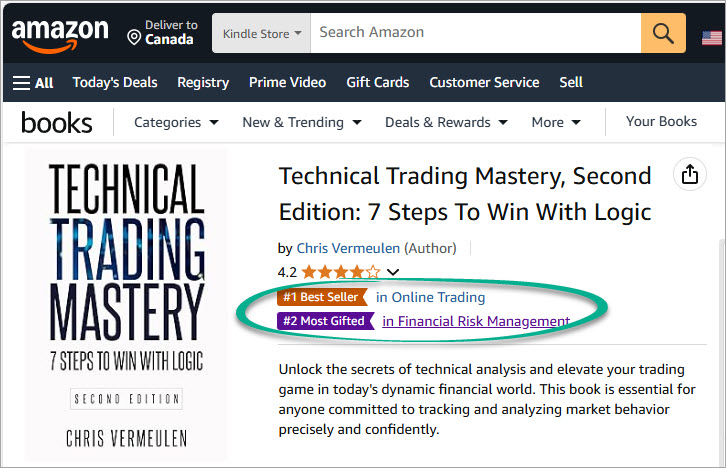

Chris Vermeulen

✔ PREMIUM ETF SIGNALS: https://thetechnicaltraders.com/investment-solutions/

✔ OPTIONS TRADING SIGNALS: https://thetechnicaltraders.com/ots/

✔ FREE ANALYSIS NEWSLETTER: https://TheTechnicalTraders.com/e-newsletter/

MY FREE INDICATORS IN MY BOOKS

Disclaimer:

The content material revealed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Change Fee or any state securities authority. The knowledge offered is basic in nature and is not tailor-made to the funding wants of any particular particular person. Nothing revealed on this web site constitutes a suggestion to purchase, promote, or maintain any specific safety, commodity, or monetary instrument. The views expressed characterize the opinions of the authors and are topic to alter at any time with out discover. Efficiency outcomes mentioned might embody dwell buying and selling outcomes and/or backtested or hypothetical information. Hypothetical outcomes are inherently restricted and don’t mirror precise buying and selling efficiency. No illustration is made that any account will or is more likely to obtain earnings or losses much like these mentioned. Previous efficiency isn’t indicative of future outcomes. All investments contain threat, together with the potential lack of principal. Testimonials and consumer experiences introduced is probably not consultant of others and don’t assure future success. Some content material might include affiliate hyperlinks or promotional materials, from which we might earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely chargeable for your individual monetary choices and comply with seek the advice of a licensed monetary skilled earlier than appearing on any info offered.