There’s a phrase usually repeated in self-help circles: “Comparability is the thief of pleasure.” For most individuals, it applies to careers, relationships, or life. For merchants, the phrase cuts even deeper as a result of buying and selling is among the few pursuits the place your profitability is continually measurable, relentlessly comparable, and infrequently judged by your self extra harshly than by anybody else.

When confidence slumps—because it inevitably does for everybody—comparability stops being a impartial lens designed to drive imporvement and turns into an emotional millstone.

The Mirage of Buying and selling Comparisons

Buying and selling creates limitless alternatives for the thoughts to attract false contrasts:

-

A peanut on social media posts screenshots of outsized wins, when you’re grinding by means of a drawdown.

-

A world index hits new highs whereas your system’s fairness curve meanders sideways.

On the floor, these comparisons seem like innocent reference factors. In actuality, they’re distorted mirrors. No two merchants run equivalent methods, function on equivalent timeframes, or expertise equivalent drawdowns. Measuring your self towards another person’s efficiency is like evaluating a marathon runner to a sprinter—it misses the purpose of each.

We additionally must think about that a lot of what you see on social media is contrived and false. I’ve written extensively through the years about faux fairness curves and buying and selling outcomes. Regardless of this actuality of the numbers supplied, they leak into your psyche.

How Comparability Steals Confidence

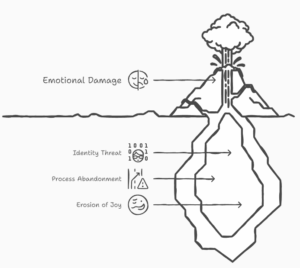

The injury isn’t simply emotional. Comparability creates structural weaknesses in a dealer’s mindset:

The injury isn’t simply emotional. Comparability creates structural weaknesses in a dealer’s mindset:

-

Identification Menace

Once you evaluate, losses cease being a few system and begin being about you. As an alternative of “my breakout system is in a traditional drawdown,” the story mutates into “I’m a foul dealer.” The excellence is delicate, however it’s the distinction between staying the course and abandoning self-discipline. -

Course of Abandonment

Beneath strain, comparability tempts you to repeat what’s working for another person. A pattern follower in a dropping streak may all of a sudden lurch into short-term scalping. A system dealer may begin buying and selling based mostly on information headlines. In each instances, the result’s chaos—the droop deepens, and confidence erodes additional. -

Erosion of Pleasure

Buying and selling begins to really feel heavy. As an alternative of curiosity, there’s anxiousness. As an alternative of self-discipline, there’s envy. Pleasure isn’t simply diminished—it’s stolen outright.

The Antidote: Returning to Course of

So how does a dealer reclaim pleasure when comparability has drained it?

-

Anchor to Expectancy, Not Fairness Curves

A system with constructive expectancy will, over time, ship outcomes. Whether or not the final ten trades have been winners or losers is irrelevant. Your benchmark is the arithmetic of your edge, not the social scoreboard of others. -

Measure in “R”

By framing trades by way of threat models as a substitute of greenback values, you detach ego from fairness. A -1R loss or +2R acquire is psychologically impartial. It’s a part of the system. {Dollars} invite comparability; R-values reinforce self-discipline. -

Settle for Slumps as Tuition

Each system, regardless of how sturdy, will undergo drawdowns. They don’t seem to be punishments however the value of admission to future earnings. To resent them is to resent the very construction of markets themselves. -

Follow Zanshin

Borrowing from Japanese martial arts, Zanshin refers to a state of calm consciousness within the current second. For merchants, it means specializing in this commerce, proper now, with out the bags of previous losses or envy of others’ good points.

Pleasure Recovered

Pleasure Recovered

Comparability whispers that your value is relative—that solely whenever you beat the index, outperform the peer group, or mimic the influencer’s P&L are you “sufficient.” However buying and selling will not be a race. It’s a non-public apply, an extended apprenticeship to chance.

In the long run, pleasure returns not whenever you “catch up” to others, however whenever you keep in mind the one correct benchmark: Did I execute nicely immediately?

Submit Views: 1,444