A Historic Reversal: FIIs Ignite a Brief Squeeze AND Construct a New Bullish Basis

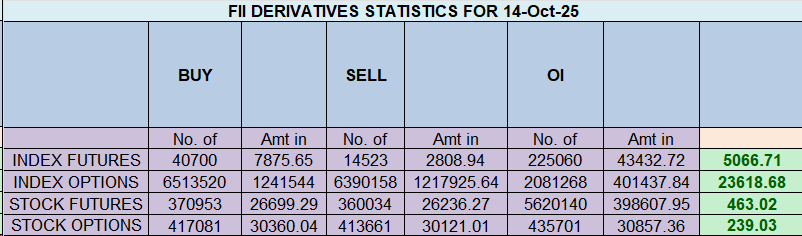

The buying and selling session of October 16, 2025, was not only a rally; it was a seismic shift available in the market’s underlying construction. The information reveals a dramatic and highly effective two-pronged offensive by the Overseas Institutional Buyers (FIIs) that has utterly reset the market’s trajectory. The headline quantity is breathtaking: FIIs had been web consumers of 22,468 contracts, price a colossal ₹4,314 crores.

Whereas the simultaneous lower in web open curiosity (OI) by 3,720 contracts factors to an enormous brief squeeze, for the primary time in weeks, this isn’t a very powerful a part of the story. The actual sign is way extra highly effective and bullish.

The Twin-Motion Offensive: A Change in Character

The breakdown of FII exercise reveals a surprising and high-conviction strategic pivot:

-

The Nice Unwinding: FIIs lined a monumental 13,536 brief contracts. This was the gasoline for the day’s explosive rally. It represents the capitulation of their outdated, profitable bearish bets as they rushed to lock in earnings, making a violent brief squeeze.

-

The New Bullish Basis: Concurrently, and way more importantly, FIIs added an enormous 12,641 new lengthy contracts. This isn’t a tactical transfer; it’s a strategic one. They aren’t simply exiting their outdated bearish trades; they’re aggressively constructing a brand new bullish basis on the identical time.

This twin motion is probably the most highly effective sign of a market turning level. The brief overlaying gives the preliminary thrust, however the initiation of an enormous new lengthy ebook gives the sustaining energy for a brand new pattern. The market’s character has basically modified in a single session.

The Retail Capitulation: A Textbook Bull Lure Reversal

In a traditional and painful market dynamic, the Shopper (retail) phase was caught utterly on the unsuitable aspect of this institutional tsunami. Because the FII-driven rally exploded upwards, retail merchants panicked and capitulated on a historic scale.

-

They lined 10,342 lengthy contracts, promoting their positions immediately into the FIIs’ shopping for storm, possible taking small earnings or exiting at breakeven and lacking the larger transfer.

-

Worse nonetheless, they instantly flipped their technique, including 10,962 new brief contracts, betting that this highly effective, institutionally-backed rally would fail.

The Perilous New Divergence

This has created a contemporary and intensely harmful market imbalance. The FIIs have signaled a significant bullish pivot with their move of funds, whereas retail merchants have now grow to be the first short-holders, positioning themselves immediately within the path of the brand new institutional shopping for energy. Whereas the FIIs’ legacy positioning stays 86% brief, their actions right now are a much more highly effective and forward-looking indicator. They’ve began the method of unwinding that brief ebook and constructing a brand new lengthy one.

Conclusion:

The rally on October sixteenth was excess of a easy brief squeeze. It was a strategic, high-conviction pivot by the FIIs, marked by each the capitulation of their outdated bearish bets and the aggressive initiation of latest bullish ones. Retail merchants have been caught in a traditional reversal, promoting their longs and shorting into the newfound power. The stage is now set for a possible continuation of this highly effective up-move, with the newly positioned retail shorts offering the gasoline. The institutional tide has turned, and the trail of least resistance has decisively shifted to the upside.

Final Evaluation may be learn right here

The Nifty has delivered a robust and textbook demonstration of how worth and time work in excellent concord. The market is now witnessing the highly effective follow-through from a collection of high-conviction timing and worth alerts which have flawlessly executed over the previous few classes. The bulls are firmly in management, however they’re now approaching the ultimate and most important hurdle that can decide whether or not this highly effective rally can proceed to a brand new all-time excessive.

The Basis: A Flawless Execution of Timing Indicators

It’s essential to grasp that the latest explosive rise was not a random occasion. It was the direct and anticipated results of a number of key technical and cyclical alerts that we’ve got been monitoring intently:

-

The Venus Ingress & Exterior Bar: As mentioned, the market shaped a robust Exterior Bar exactly on the Venus Ingress date. This confluence of a significant worth sample on a key timing occasion was a transparent sign {that a} new, highly effective pattern was about to start. The next rally is the direct affirmation of this highly effective setup.

-

The Bayer Rule 6 Backside: In the present day, the market noticed an ideal and highly effective transfer pushed by one other main cyclical rule. As mentioned in our latest video, Bayer Rule 6 pinpointed a significant bottoming alternative:

“The value is in backside when Mars was in 16 levels 35 minutes of some signal and plus 30 levels.”

The explosive rally we at the moment are witnessing is the market reacting to this highly effective, pre-calculated temporal low.

The Remaining Take a look at: The ABCD Sample and the 25790-25800 PRZ

After this highly effective, cycle-driven advance, the Nifty is now getting into its most important problem but. The value is presently nearing it essential resistance zone of 25790-25800.

This isn’t an arbitrary degree. This zone represents the Potential Reversal Zone (PRZ) for a traditional ABCD harmonic sample. In technical evaluation, these PRZs are calculated areas the place a pattern is mathematically susceptible to exhausting itself and reversing. That is the ultimate and most formidable line of protection for the bears.

The Two Eventualities: All-Time Excessive or a Fall to 25k

This has introduced the market to a transparent, high-stakes “make-or-break” level. The battle between the highly effective upward momentum and the harmonic resistance on the PRZ will outline the market’s subsequent main pattern. The circumstances for the subsequent transfer at the moment are crystal clear:

-

The Bullish Case (The Breakout): For the bulls to substantiate their absolute management and unleash the subsequent leg of the rally, they need to obtain two consecutive each day closes above the 25800 degree. A profitable protection of this zone for 2 days would validate the breakout, take in all promoting strain, and open a transparent path in the direction of the all-time excessive of 26277.

-

The Bearish Case (The Rejection): If the bulls are unable to safe two consecutive closes above this 25790-25800 PRZ, it is going to be a significant signal of exhaustion. A failure at a key harmonic resistance degree could be a major victory for the bears, possible triggering a pointy reversal and a punishing fall again in the direction of the psychological 25,000 degree.

Conclusion:

The market has flawlessly adopted the script laid out by our cyclical and astrological evaluation, bottoming out as anticipated and staging a robust rally. Now, it faces its final check. The battle on the 25790-25800 PRZ isn’t just a minor skirmish; it’s the ultimate gatekeeper that stands between the present worth and a brand new all-time excessive. The subsequent two classes can be essential. Watch this vary with excessive vigilance.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 25615 for a transfer in the direction of 25695/25775. Bears will get lively beneath 25456 for a transfer in the direction of 24376/25225

Merchants could be careful for potential intraday reversals at 09:22,11:08,12:03,01:11,02:57 The right way to Discover and Commerce Intraday Reversal Occasions

Nifty Oct Futures Open Curiosity Quantity stood at 1.77 lakh cr , witnessing liquidation of 51.7Lakh contracts. Moreover, the rise in Value of Carry implies that there was closeure of SHORT positions right now.

Nifty Advance Decline Ratio at 43:07 and Nifty Rollover Value is @24980 closed above it.

Nifty Gann Month-to-month Pattern Change degree 24731 closed above it.

Nifty has closed above its 21 SMA @ 25225 Pattern is Purchase on Dips until above 25225

Within the money phase, Overseas Institutional Buyers (FII) purchased 997cr , whereas Home Institutional Buyers (DII) purchased 4076 cr.

Merchants who comply with the musical octave buying and selling path could discover priceless insights in predicting Nifty’s actions. In keeping with this path, Nifty could comply with a path of 23037-23722-24408-25134-25860 Because of this merchants can take a place and probably journey the transfer as Nifty strikes via these ranges.After all, it’s necessary to remember that buying and selling is inherently dangerous and market actions may be unpredictable.

For Positional Merchants, The Nifty Futures’ Pattern Change Stage is At 25192. Going Lengthy Or Brief Above Or Beneath This Stage Can Assist Them Keep On The Similar Facet As Establishments, With A Greater Threat-reward Ratio. Intraday Merchants Can Maintain An Eye On 25595, Which Acts As An Intraday Pattern Change Stage.

Nifty Intraday Buying and selling Ranges

Purchase Above 25585 Tgt 25625, 25666 and 25708 ( Nifty Spot Ranges)

Promote Beneath 25544 Tgt 25508, 25475 and 25425 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated