By RoboForex Analytical Division

Market sentiment stays extremely delicate to rhetoric from the Federal Reserve and statements from the White Home. That is significantly true given the protracted authorities shutdown and the resurgence of commerce disputes with a number of Asian companions.

Whereas heightened geopolitical tensions within the area are bolstering demand for the yen as a safe-haven asset, the broader financial coverage divergence between the Fed and the Financial institution of Japan continues to favour the US greenback.

The buck stays below stress resulting from ongoing uncertainty from the shutdown and escalating “Trump commerce wars.” These elements are amplifying market volatility, prompting merchants to lock in positions forward of key inflation information and scheduled speeches from Fed officers.

Conversely, the Japanese yen is attracting reasonable help from falling US Treasury yields and rising demand for safe-haven belongings.

Technical Evaluation: USD/JPY

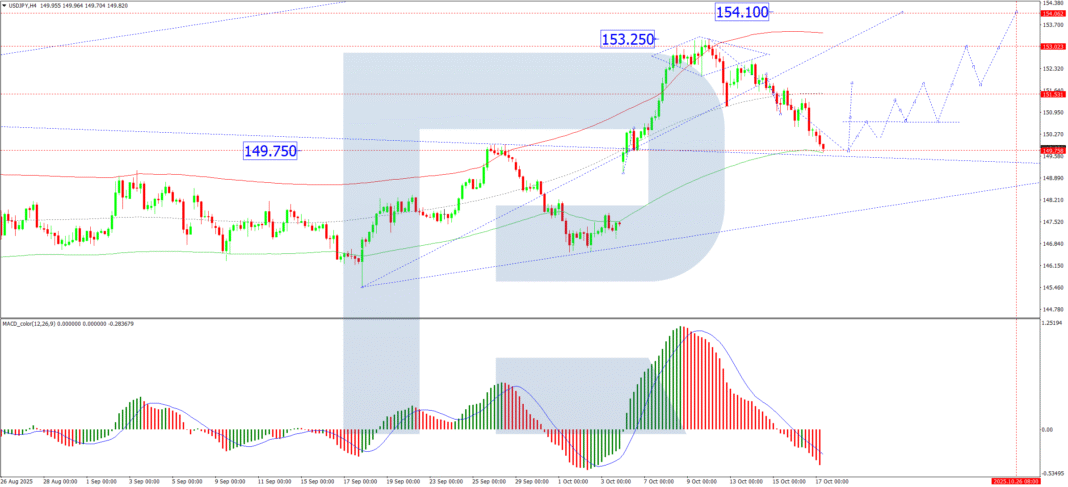

H4 Chart:

The USD/JPY pair has accomplished a corrective decline, discovering a base at 149.75. We anticipate this correction is now concluding, paving the way in which for a progress wave with an preliminary goal of 151.55 (testing it from under). Following this, a pullback in direction of 150.60 is believable, probably forming a neighborhood consolidation vary. An upward breakout from this vary would sign a continuation of the bullish momentum in direction of 154.10, which serves as the following native goal. This outlook is technically confirmed by the MACD indicator, whose sign line is at lows under zero and seems to be reversing upwards, suggesting a brand new progress impulse is probably going forming.

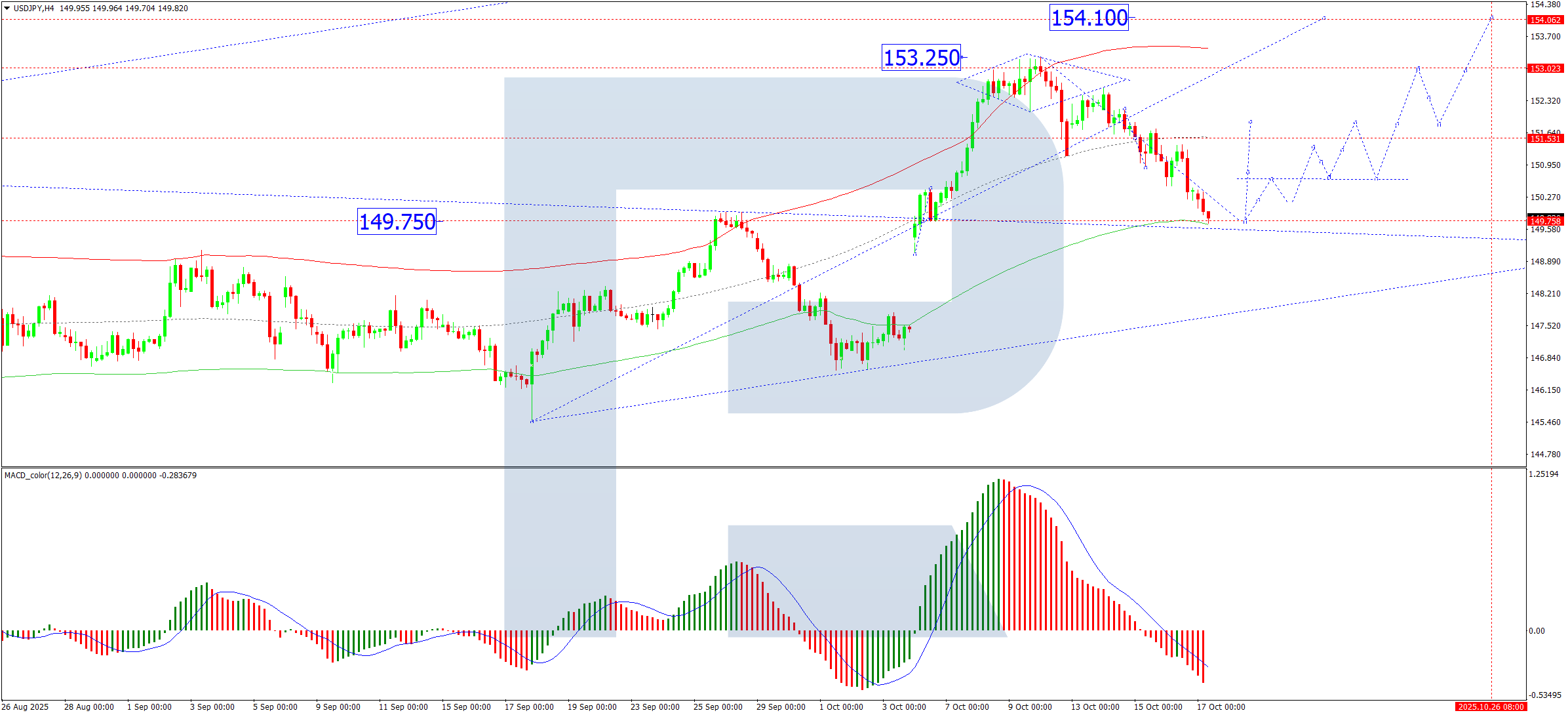

H1 Chart:

The market concluded its downward wave at 149.75 and is at present consolidating on the vary’s decrease boundary. We anticipate an preliminary progress wave to 151.55, to be adopted by a possible correction to 150.60. The bullish state of affairs is additional supported by the Stochastic oscillator; its sign strains are deep within the oversold territory (under 20) and are poised to rise in direction of 80, indicating important restoration potential within the coming hours.

Conclusion

The technical image suggests the yen’s correction is finalising. Whereas safe-haven flows present underlying help, the dominant driver stays the numerous financial coverage divergence, which is predicted to in the end favour the greenback. The fast trajectory will likely be guided by the market’s response to imminent US information and Fed commentary.

Disclaimer:

Any forecasts contained herein are based mostly on the writer’s specific opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes based mostly on buying and selling suggestions and opinions contained herein.

- The US authorities shutdown prolonged till a minimum of Monday. Silver costs hit new information Oct 17, 2025

- Australia’s labor market is cooling. The Canadian greenback is depreciating below the affect of falling oil costs Oct 16, 2025

- Gold Extends Its Rally as Protected-Haven Demand Builds Oct 16, 2025

- Oil costs proceed to fall. Platinum narrows its value hole with gold Oct 15, 2025

- British Pound Braces for Additional Losses Oct 15, 2025

- Buyers focus shifts to Q3 earnings. Silver units all-time excessive since 1980 Oct 10, 2025

- EUR/USD Plummets as Buyers Shun Threat Oct 10, 2025

- Silver nears $50 per ounce mark. Oil costs rise amid stock drawdowns Oct 9, 2025

- GBP/USD Halts Decline however Inflation Dangers Linger Oct 9, 2025

- RBNZ unexpectedly cuts the speed by 0.5%. Pure gasoline costs leap amid drop in every day manufacturing Oct 8, 2025