The worst day in weeks led to the worst week in months. Particularly, Friday’s 2.7% stumble from the S&P 500 left it at a lack of 2.4% for the five-day stretch… the worst week since early April, proper earlier than the market hit backside and started an unimaginable rally. That’s unlikely this time round although. Then, the market had the benefit of with the ability to begin the hassle out following a slightly dramatic selloff. Now, shares are nonetheless close to report highs, and nonetheless priced at very frothy valuations. If something, a slew of indicators at the moment are immediately warning of a pullback. We’ll see if the bulls are prepared to present it to the bears.

The irony? The sheer pace and scope of Friday’s selloff is arguably the most effective factor going for the market at the moment. This “an excessive amount of, too quick” dip already has the discount hunters sniffing round.

An finish to the federal government shutdown and just a little less-aggressive tariff posturing is after all the important thing. It appears to be like like most merchants have been anticipating and finish to the shutdown by the top of the week. Once they didn’t get it on Friday and as a substitute have been handled to rekindled tariff worries, they determined en masse to take a bunch of their danger off of the desk in entrance of the weekend. It’s onerous in charge them, although it does make issues troublesome to get a learn on from right here.

We’ll attempt to determine the market’s believable paths from right here. First although, let’s take a look at final week’s financial studies and preview what’s coming this week.

Financial Information Evaluation

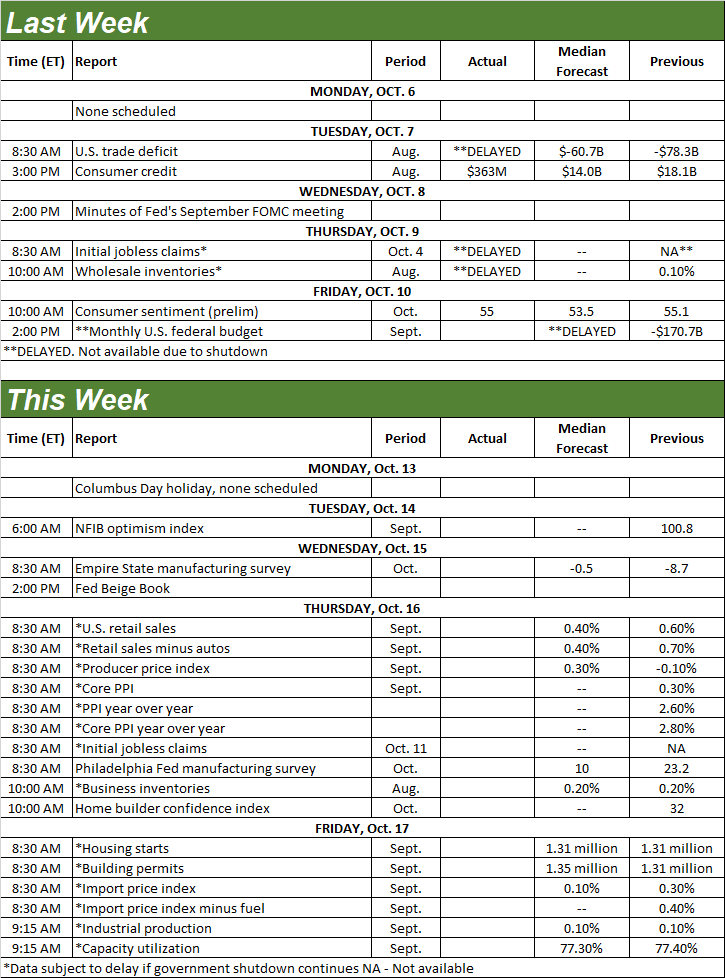

Really, there weren’t any main financial bulletins launched final week, principally as a result of shutdown. Even with out a shutdown although, there wouldn’t have been a lot. We stay much more excited about final month’s jobs knowledge, which was due per week in the past, however has been delayed by the shutdown. We’ll take our look after we lastly have the info in-hand.

Every part we did hear is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

We’ll assume we’re going to listen to all the things as scheduled this week. Simply keep in mind that we’ll get nothing from the federal authorities’s workplaces and businesses till the shutdown ends. As soon as it does finish although, a bunch of studies are all going to be unleashed without delay.

Assuming all the things is posted when due, the occasion begins in earnest on Thursday with a take a look at final month’s inflation figures. We don’t have any predictions for the place issues are apt to level this time round, however as of a month in the past costs have been clearly edging larger once more.

Shopper, Producer Inflation Charts

Supply: Bureau of Labor Statistics, TradeStation

Additionally on Thursday preserve your eyes and ears peeled for September’s retail gross sales report. Forecasts counsel a slight slowdown from August’s progress, however progress remains to be within the playing cards all the identical.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

Friday shall be simply as busy (hopefully), beginning with September’s housing begins and constructing permits. Chances are you’ll recall each fell a month earlier, whereas permits now seem like in a full-blown nosedive, underscoring simply how a lot hassle the actual property market is in within the shadow of wildly-high costs. Economists are on the lookout for about the identical numbers in September that we acquired in August, which is something however a step in the correct path.

Housing Begins, Constructing Permits Charts

Supply: Census Bureau, TradeStation

Shortly after that on Friday morning properly get final month’s take a look at the nation’s industrial exercise and use of the nation’s manufacturing capability, from the Federal Reserve. As is the case with September’s begins and permits, economists consider manufacturing facility utilization and output are going to roll in at about the identical ranges once more. That’s… not precisely thrilling.

Capability Utilization, Industrial Manufacturing Charts

Supply: Federal Reserve, TradeStation

Inventory Market Index Evaluation

There’s no have to introduce this week’s evaluation with phrases. We’ll simply begin with a every day chart of the S&P 500, because it speaks volumes. In the event you’ve not seen it but, sit down first, after which have a look. Simply, wow.

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

The steep selloff took form after a couple of unsuccessful makes an attempt to interrupt previous a technical ceiling (purple, dashed) that had been holding the bulls again since late final month. And, the stumble additionally dragged the index below the rising help line (purple, dashed) that had been steering it larger since Might; each confirmed occasion of help and a pushoff of this line is highlighted in yellow. The one “victory” of kinds is that the pullback didn’t pull the S&P 500 below its 50-day transferring common line (purple) at 6,528. Then once more, maybe there simply wasn’t sufficient time or sufficient bears taking note of do any extra injury.

The NASDAQ Composite’s every day chart appears to be like about the identical, though curiously, it’s extra evident with this index that the bearish quantity has really been creeping larger for the reason that starting of the week.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

The truth is, a more in-depth take a look at the NASDAQ’s breadth and depth (advancers vs. decliners, and bullish quantity vs. bearish quantity) says the composite’s quantity and total “lean” has really been tilted in a bearish path since late final month. Had been merchants planning on — and even relying on — one thing like this taking place prior to later, and eventually determined they’d the catalyst they wanted? That’s type of what it appears to be like like. If that’s the case, don’t be stunned to see this one-day selloff evolve into the long-overdue correction, even when the bulls push again a bit to start out this week.

NASDAQ Advancers/Decliners, Bullish/Bearish Quantity

Supply: TradeNavigator

Maybe probably the most noteworthy element price highlighting on the charts of the S&P 500 and the NASDAQ Composite above, nonetheless, is that their volatility indexes (the VIX and VXN, respectively) each surged larger, but are nonetheless miles under ranges that might counsel concern has peaked and a trade-worth backside has been made. The surge of the VIX and VXN really suggests many merchants didn’t see this stumble coming fairly prefer it did precisely when it did, even when the buying and selling crowd sensed this setback was within the offing.

Both method, this has extra bearish undertones and implications than not.

Here is the weekly chart of the S&P 500 for just a little extra perspective, but additionally to function a reminder for why it was really easy to up-end the market with not-entirely-surprising information. It’s troublesome to not discover how rather more room and cause there may be for profit-taking.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

That being stated, it’s the weekly chart we’ll be watching most intently from right here for affirmation that there’s extra draw back in retailer. If an even bigger bearish transfer is within the playing cards, will probably be signaled by the VIX’s transfer above its technical ceiling round 23 (purple, dashed) paired with the S&P 500’s slide below its 50-day transferring common line and a bearish cross of the weekly chart’s MACD traces… which simply acquired a complete lot nearer final week.

Positive, it’s actually attainable that the market might barely get better this week, whereas the VIX peels again a bit. Simply don’t bounce to conclusions about that transfer. It wouldn’t imply we’re out of the woods but. It’s simply the results of the bulls and the bears regrouping, and contemplating their subsequent transfer. Each side might simply find yourself agreeing a correction remains to be the trail of least resistance for now.

It’s too quickly to speak about draw back targets, just because there’s no certainty any extra actual draw back is in retailer. If it turns into simple although, we’ll speak about technical flooring then, beginning with the 200-day transferring common line (inexperienced) at 6,050.