You’ve most likely heard the phrase “retracement” or “retrace” fairly incessantly if you happen to’re curious about buying and selling the monetary markets. However do you really know what value retracements are, why they’re so necessary and find out how to correctly reap the benefits of them? Maybe not, however even if you happen to do, right this moment’s lesson goes to shed new mild on find out how to make the most of these extraordinarily highly effective market occasions…

You’ve most likely heard the phrase “retracement” or “retrace” fairly incessantly if you happen to’re curious about buying and selling the monetary markets. However do you really know what value retracements are, why they’re so necessary and find out how to correctly reap the benefits of them? Maybe not, however even if you happen to do, right this moment’s lesson goes to shed new mild on find out how to make the most of these extraordinarily highly effective market occasions…

A retracement in a market is a reasonably straightforward idea to outline and perceive. Merely put, it’s precisely what it seems like: a interval when value retraces again on a latest transfer, both up or down. Take into consideration “retracing your steps”; going again the identical approach you got here. It’s mainly a reversal of a latest value transfer.

Why are retracements necessary? For quite a lot of causes: They’re alternatives to enter the market at a “higher value”, they permit for optimum cease loss placement, improved threat reward and extra. A retrace entry is extra conservative than a “market entry” for instance and is taken into account a “safer” entry sort. In the end, the purpose of a dealer is receive one of the best entry value and handle threat nearly as good as attainable while additionally growing returns; the retracement entry is a instrument that means that you can do all three of this stuff.

This lesson will cowl all facets of buying and selling retracements and can aid you perceive them higher and put them to make use of to hopefully enhance your general buying and selling efficiency.

Now, let’s focus on a number of the Professionals and Cons of retracement buying and selling earlier than we take a look at some instance charts…

Professionals of Retracement Buying and selling

Let’s discuss a number of the many “Professionals” of retracement buying and selling. To be trustworthy, retracement buying and selling is mainly the way you commerce like a sniper, which, if you happen to’ve adopted me for any size of time, is my most popular technique of buying and selling.

- Increased Chance Entries – The very nature of a pull again or retrace implies that value is more likely to proceed shifting within the path of the preliminary transfer when the retrace ends. Therefore, if you happen to see a robust value motion sign at a degree following a retracement, it’s very high-probability entry as a result of all indicators are pointing to cost bouncing from that time. Now, it doesn’t at all times occur, however ready for a retrace to a degree with a sign, is the highest-probability approach you’ll be able to commerce. Markets rotate again to the “imply” or “common” value again and again; that is clear by any value chart for a couple of minutes. So, once you see this rotation or retrace occur, begin on the lookout for an entry level there as a result of it’s a a lot higher-probability entry level than merely coming into “at market” like most merchants do.

- Fewer Untimely Cease-Outs – A retracement permits extra flexibility with cease loss placement. Primarily, in which you can place the cease additional away from any space on the chart that’s more likely to be hit (if the commerce you’re taking is to exercise in any respect). Putting stops additional away from key ranges or shifting averages or additional away from a pin bar excessive or low for instance, offers the commerce the next likelihood of understanding.

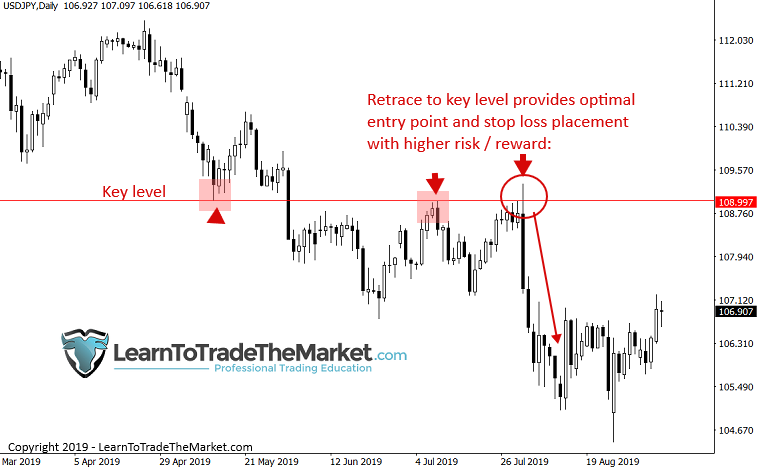

- Higher Danger Rewards – Retracement entries theoretically permit you to place a “tighter” cease loss on a commerce since you’re coming into nearer to a key degree otherwise you’re coming into at a pin bar 50% degree on a commerce entry trick entry for instance. So, must you select to take action, you’ll be able to place a cease a lot nearer than if you happen to entered a commerce that didn’t occur after a retrace or if you happen to entered a pin bar commerce on the excessive or low of the pin, for instance. Instance: a 100 pip cease and 200 pip goal can simply turn out to be a 50 pip cease and 250 pip goal on a retrace entry. Be aware: you don’t want to position a tighter cease, it’s elective, however the possibility IS There on a retrace entry if you would like it. The choice, utilizing a regular width cease has the benefit of lowering the probabilities of a untimely cease out.

- A threat reward can be barely elevated even if you happen to use a regular cease loss, as an alternative of a “tighter one”. Instance: a 100 pip cease and a 200 pip goal can simply turn out to be a 100 pip cease and a 250 pip goal. Why? It’s as a result of a retrace entry allows you to enter the market when it has “extra room” to run in your path, on account of the truth that value has pulled again and it thus has extra distance to maneuver earlier than it retraces once more as in comparison with if you happen to entered at a “worse value” additional up or down.

Cons of Retracement Buying and selling

In fact I’m going to be trustworthy with you and allow you to know a number of the “cons” of retracement buying and selling, there are just a few that you have to be conscious of. Nonetheless, this doesn’t imply you shouldn’t attempt to be taught retracement buying and selling and add it to your buying and selling “toolbox”, as a result of the professionals FAR outweigh the cons.

- Extra Missed Trades: Good trades will “get away” typically when ready for a retracement that doesn’t occur, for instance. This will check your nerves and buying and selling mindset and can annoy even one of the best merchants. However belief me, lacking out on trades isn’t the worst factor on this planet and it’s higher to overlook out on some trades than to over-trade, that’s for certain.

- Much less Trades in Basic – A whole lot of the time, markets merely don’t retrace sufficient to set off the extra conservative entry that comes with a pull again. As a substitute, they could simply hold going with minimal retracements. This implies you’ll have much less possibilities to commerce general as in comparison with somebody who isn’t primarily ready for retraces.

- Because of the above two factors, retracement buying and selling may be irritating and takes unbelievable self-discipline. Nonetheless, if you happen to develop this self-discipline you’ll be WELL forward of the plenty of shedding merchants and so retracement buying and selling may help you develop the self-discipline you could need to succeed at buying and selling it doesn’t matter what entry technique you find yourself utilizing.

Retracements Present Flexibility in Cease Loss Placements

Putting your cease loss on the unsuitable level can get you knocked out of a commerce prematurely, that you simply in any other case had been proper on. By studying to watch for market pull backs or retracements, you’ll not solely enter the market at a higher-probability level, however you’ll additionally have the ability to place your cease loss at a a lot safer level on the chart.

- Fairly often, merchants get discouraged as a result of they get stopped out of a commerce that technically they had been proper on. Putting a cease loss on the unsuitable level on a chart can get you taken out of a commerce earlier than the market actually has an opportunity to get stepping into your path. A retracement provides up a nifty resolution to this downside by permitting you to place a safer and wider cease loss on a commerce, providing you with a greater likelihood at earning money on that commerce.

- When a market retraces or pulls again, particularly inside a trending market, it’s offering you with a possibility to position your cease loss at a degree on the chart that may be a lot much less more likely to knock you out of a commerce. Since most retraces occur into help or resistance ranges, you’ll be able to place the cease loss additional past that degree (safer) which is considerably much less more likely to be hit than if it was nearer to the extent. Utilizing what I name a “commonplace” cease loss (not a good one) on this occasion gives you one of the best likelihood at avoiding a untimely knock-out of a commerce.

The Totally different Retrace Entry Varieties: Examples

Subsequent, let’s check out a number of the totally different retrace entry sorts so to get a transparent take a look at what they could appear like…

- Retrace Entry With out Value Motion Sign

Within the instance beneath, you’ll be able to see value retraced or pulled again to the important thing horizontal degree proven within the chart. There was no apparent value motion sign right here however we are able to see value rapidly sold-off from that degree after simply barely pushing above it. This offered merchants a really excessive potential threat reward state of affairs in the event that they entered on a “blind entry” on the degree with a good cease loss…

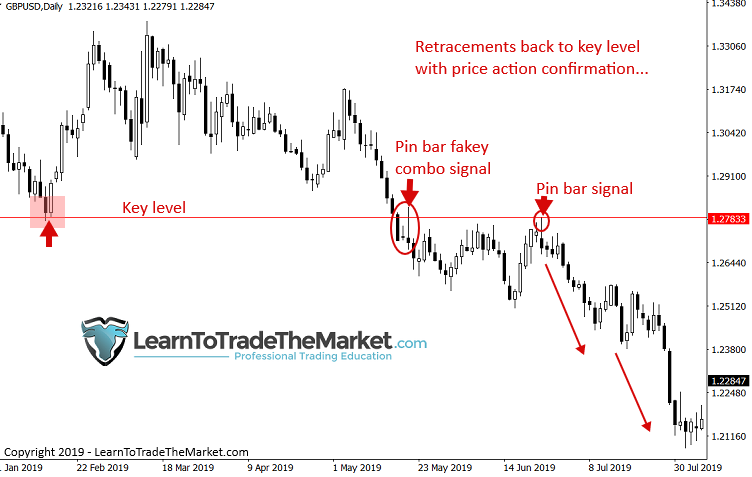

- Retrace to Key Stage with Value Motion Confluence

Maybe my favourite buying and selling technique of all time is the next instance: Watch for value to retrace again up or right down to an current key degree on the day by day chart timeframe, then look ahead to an apparent value motion sign to type there. In my view, that is the highest-probability method to commerce…

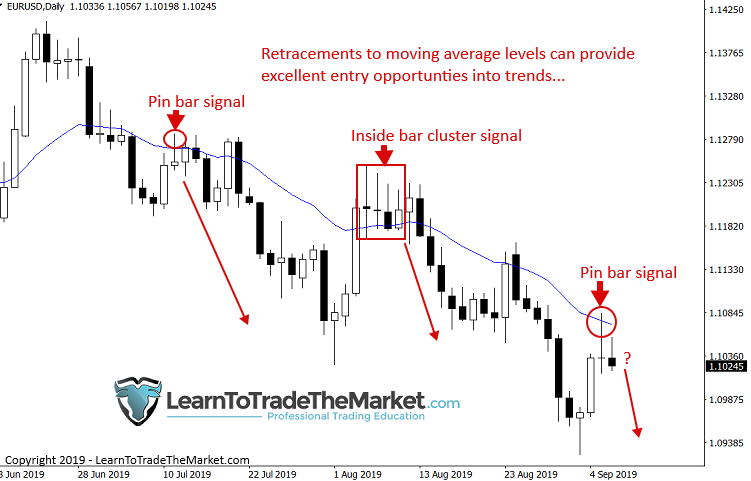

- Retrace to Transferring Common (rotation to the imply)

Markets tend to retrace to the imply or common value, which you’ll be able to see by placing a shifting common in your charts. Proven beneath is the 21 day ema, a stable short-term shifting common to see the pattern on the day by day chart. When value retraces again to this degree it’s best to watch carefully for value motion alerts forming there to get a high-probability entry and get in on a trending market…

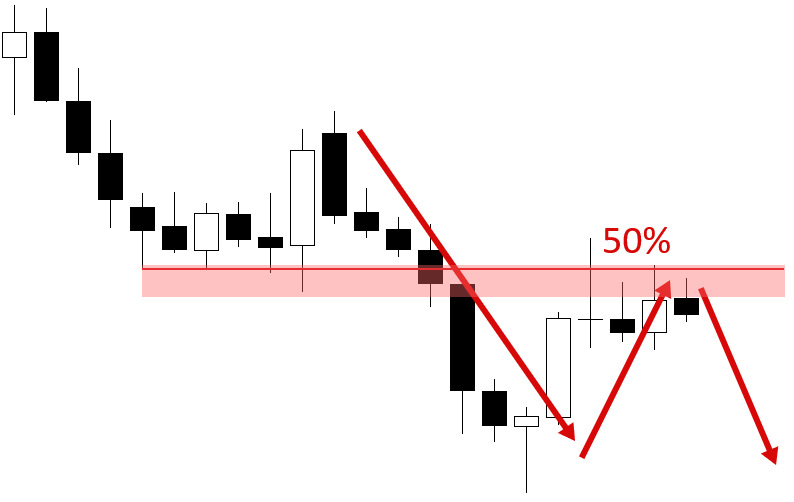

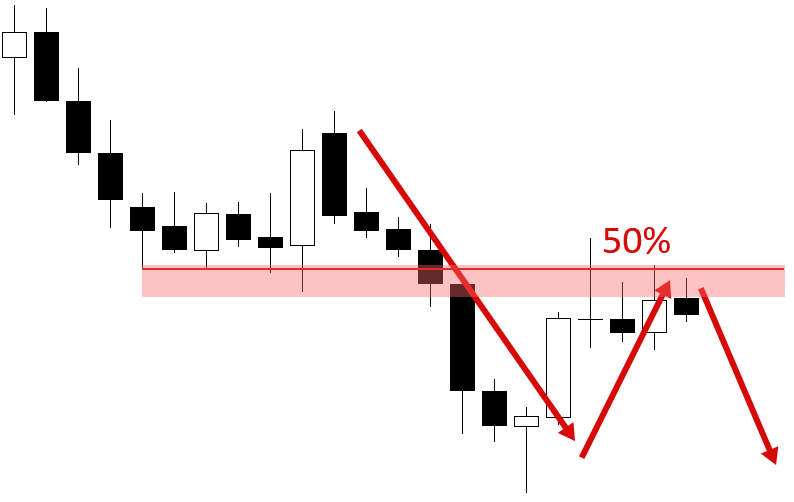

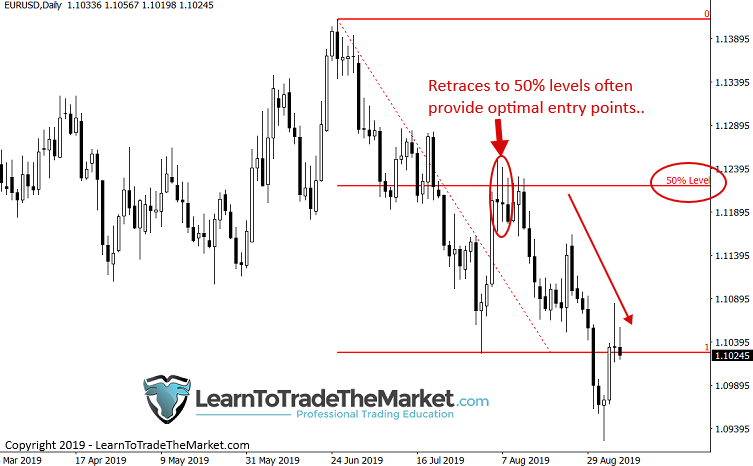

Value tends to retrace roughly 50% of any main transfer and infrequently occasions even short-term strikes. It is a well-documented phenomenon and if you happen to take a look at any chart you’ll be able to see it occurs, A LOT. Therefore, we are able to look ahead to pull backs to those 50% areas as they may fairly often be formidable ranges for value to maneuver past, and in consequence, value strikes again within the path of the preliminary transfer from that fifty% degree. It doesn’t occur EVERY time, however it occurs typically sufficient to make it a vital instrument in your retracement buying and selling instrument field…

- Retrace Entry of a Sign Bar or Sign Space

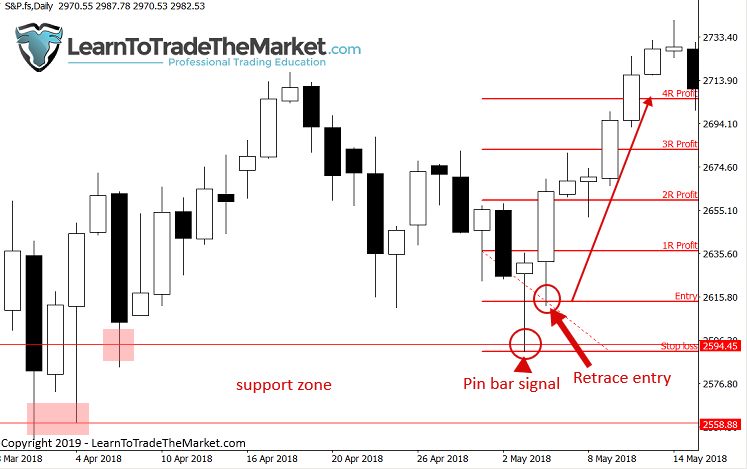

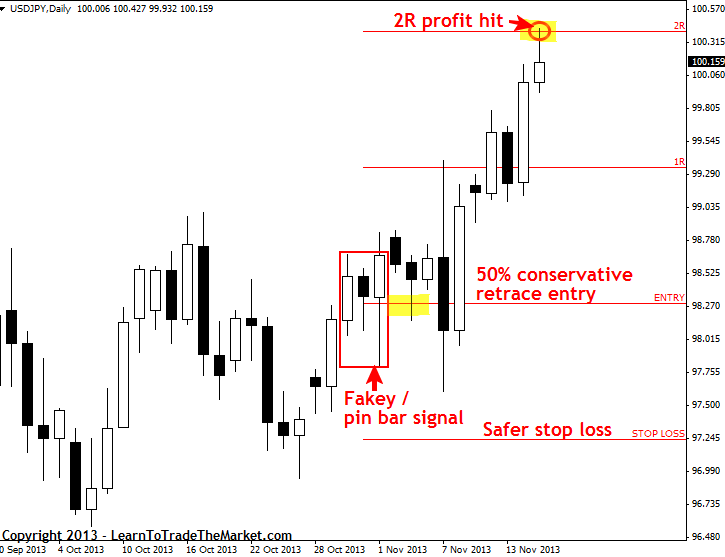

One more approach we are able to make the most of retracements can also be very efficient but somewhat totally different than these we now have mentioned already. What we’re beneath is what I name a “50% pin bar retrace“. Usually, on longer-tailed pin bars, you will note value retraces round half the space from excessive to low of the sign bar, offering you the potential to enter at a greater value and get a safer or tighter cease loss.

Instance 1: You possibly can see beneath how a 4R revenue was attainable by ready for the retrace and coming into close to the pin’s 50% degree.

Instance 2: You possibly can see beneath how a 2R revenue was attainable by ready for the retrace and coming into close to the fakey patterns 50% space.

- Retrace Entry Again to an Occasion Space or Prior PA Sign

When value retraces again to what I name an “occasion space” it’s a really high-probability space to search for trades at. As you’ll be able to see beneath, value retraces again to an current occasion space the place a pin bar sign fashioned after which types one other (bearish this time) pin bar earlier than an enormous sell-off takes place…

Conclusion

You now have a stable introduction and (hopefully) understanding of what value motion retracements are, why are they necessary and find out how to commerce them. While there is a little more to it than what I mentioned right here, this lesson offers you a superb basis to construct from and supplies you with some instruments you can begin placing to work in your buying and selling routine this week and into the long run.

If you wish to be taught extra about retracement buying and selling and get day by day updates on any potential retracement trades, take a look at my skilled buying and selling course and observe my day by day commerce setups e-newsletter. It will each deepen your understanding of retracements and in addition aid you apply these ideas to real-time value motion alerts then you’ll be able to check and examine the outcomes between aggressive entries (like these on this article) and conventional entries that you simply’re most likely extra conversant in. Bear in mind, I’m at all times right here that will help you and share my information with you, so continue learning and training.

Please Go away A Remark Under With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.