The AI growth is way from over it’s evolving. As we head into 2026, a brand new crop of AI-focused firms (and a few reinvented giants) are poised to steer the cost. Beneath we highlight 5 high AI shares primed for large strikes, from under-the-radar infrastructure performs to family names doubling down on AI. Every made our listing for a transparent cause – and every comes with a daring prediction for the yr forward. Let’s dive in.

1. Nebius Group (NBIS) – AI’s Hidden Infrastructure Powerhouse

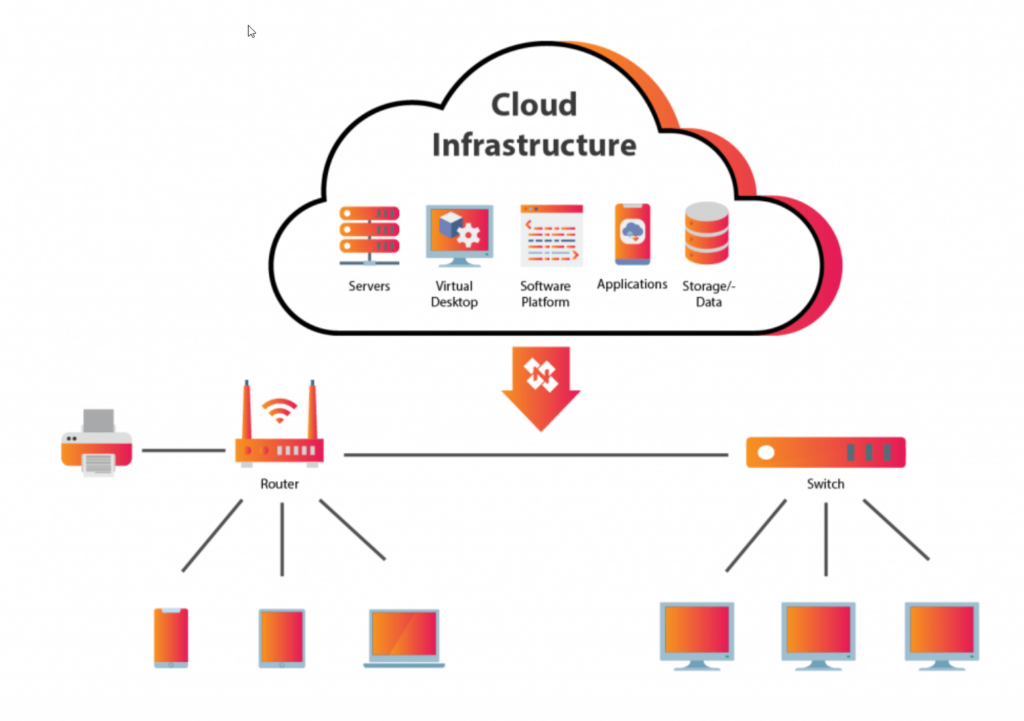

Nebius builds full-stack AI cloud infrastructure – assume large GPU information facilities, cloud platforms, and instruments – basically offering the “picks and shovels” for the AI gold rush. In 2025, Nebius signed a $17 billion take care of Microsoft and a $3 billion take care of Meta to produce devoted AI cloud capability. These megadeals despatched NBIS inventory hovering – up 248% year-to-date ultimately test – and vaulted Nebius to a $25+ billion market cap.

The corporate’s income jumped 355% year-over-year final quarter, and it’s projecting a leap in recurring income from about $550 million now to $7–9 billion by finish of 2026. The one actual limitation? How briskly it may possibly set up extra GPUs.

2026 worth goal: $180+. In the event that they hit even the low finish of that $7B ARR goal, the inventory might re-rate dramatically. Nebius is a high-conviction AI rocket – volatility and all.

2. T1 Vitality (TE) – The place AI’s Energy Starvation Meets a Inexperienced Supercycle

AI is an power hog. Enter T1 Vitality, a small-cap firm positioning itself on the nexus of AI and clear power. Previously referred to as FREYR Battery, it rebranded and now provides superior photo voltaic modules and battery options. T1 is constructing a 2.1 GW photo voltaic cell manufacturing facility in Texas and increasing its U.S.-based power infrastructure.

In 2025, TE jumped 34% in a single premarket session after a $75 million take care of Nextracker. The inventory has gained ~55% YTD and almost 300% over the previous yr. With huge tasks in movement and a revived narrative, TE is driving the dual tailwinds of AI information heart demand and the renewables growth.

2026 worth goal: $12. Execution threat is excessive, however this inventory might double once more if momentum continues.

3. Nvidia (NVDA) – The Chip Champion Powering the AI Arms Race

Nvidia stays the undisputed king of AI {hardware}. Its GPUs energy just about each fashionable AI mannequin, and the corporate posted $57 billion in income final quarter alone. Knowledge heart gross sales hit $51.2B, up 66% YoY. Its latest GPUs are promoting out quick, and cloud GPUs are offered out throughout main suppliers.

Regardless of competitors, Nvidia holds ~70% of the AI accelerator market. It’s additionally increasing into cloud-based AI providers, automotive platforms, and returning billions to shareholders by way of buybacks.

2026 worth goal: $300+. A return to all-time highs is on the desk if the AI cycle continues. For merchants, this stays a must-own title in AI.

4. Amazon.com (AMZN) – The Cloud Large’s AI Second Act

Amazon’s AWS cloud unit is now laser-focused on AI. In late 2025, Amazon signed a seven-year, $38 billion cloud partnership with OpenAI. Additionally they introduced a $50 billion plan to construct 1.3 GW of AI cloud infrastructure for the U.S. authorities. AWS development is reaccelerating to twenty%+, and Amazon is layering AI throughout Alexa, retail, and promoting.

Analysts have began to take discover, with some issuing worth targets above $300. Amazon trades at an affordable a number of given its development and is quietly changing into a significant AI platform play.

2026 worth goal: $300. If AWS continues to outperform and Amazon’s AI story matures, this degree is properly inside attain.

5. Palantir Applied sciences (PLTR) – The AI Software program Secret Weapon

Palantir has reinvented itself with its Synthetic Intelligence Platform (AIP), which helps organizations plug LLMs into personal information. Demand for AIP is surging, with income development accelerating to 63% and an order backlog now over $8.6 billion.

Palantir’s platforms permit safe, enterprise-grade AI deployment that opponents can’t simply replicate. From navy functions to international companies, clients are scaling rapidly. The inventory is up 122% in 2025.

2026 worth goal: $30+. With profitability enhancing and utilization increasing, Palantir might simply double once more.

Last Ideas

The AI revolution is creating winners in each nook of the market. Whether or not it’s Nebius supplying the infrastructure, T1 Vitality powering the motion, Nvidia making the chips, Amazon internet hosting the fashions, or Palantir serving to organizations really use AI – these 5 firms are main the way in which.

Place sizing, timing, and continued story circulation will matter. However the tailwinds listed here are actual. These aren’t fluff performs – they’ve contracts, clients, and charts transferring in the proper path. Merchants, take word: 2026 is shaping as much as be one other explosive yr for AI. Keep sharp.

How To Commerce These 5 AI Shares Utilizing Help, Resistance And Alerts

Choosing the right AI names is one factor. Buying and selling them with construction is the place the true edge is.

NBIS, TE, NVDA, AMZN and PLTR are all robust tales, however they won’t transfer in a straight line. They are going to grind, pretend out, rip, pull again and shake merchants out of excellent concepts. That’s the place assist, resistance and alerts matter.

Right here is the straightforward playbook.

1. Begin With Key Ranges

For every ticker, give attention to three varieties of ranges:

- Main assist

Prior lows that held, huge consolidation flooring, zones the place patrons stepped in with actual quantity - Main resistance

Prior highs, failed breakouts, apparent ranges everyone seems to be watching - Psychological costs

Spherical numbers like 10, 25, 50, 100, 150 and 200 that usually act like magnets or partitions

You do not want ten indicators cluttering the display. Worth, ranges and quantity inform the story.

2. Let The Scanner Do The Heavy Lifting

As an alternative of manually flipping by way of chart after chart, you may let a instrument do this for you.

That’s what my Help & Resistance Screener is constructed for:

- It scans the marketplace for tickers sitting close to main assist or resistance

- It flags shares which are coiling underneath breakout ranges or retesting key flooring

- It helps you notice the place threat and reward are skewed in your favor

You’ll be able to test it out right here:

Help & Resistance Screener: https://www.findbettertrades.com/support-resistance-screener?aff=7101e814b48f2f39d846f83a1847d6c2ddf76e9d3306df9fcb61be9fab4b912c

The thought is easy. Let the scanner floor setups so you aren’t chained to the display all day guessing.

3. Flip Large Concepts Into Actual Commerce Plans

Daring calls like NBIS to 180 or huge upside in TE are nice, however they want construction.

For every inventory:

- Outline the development

Increased highs and better lows on the day by day, or a transparent base forming - Choose your set off degree

A breakout over a clear resistance zone, or a bounce off main assist - Set alerts at these set off ranges

You get notified when worth is the place you needed it, not in the course of nowhere - Map targets and stops

First goal close to current highs, second goal close to your greater thesis degree, cease tucked beneath a transparent assist

Now the thought isn’t just “I like this inventory” however “I do know the place I get in, the place I’m incorrect, and the place I take earnings.”

4. How This Applies To These 5 AI Names

These 5 are constructed for this strategy:

- NBIS

Excessive development AI infrastructure title. Use ranges to keep away from chasing breakouts and to purchase pullbacks into assist on the way in which to that 180 thesis. - TE

Risky power plus AI play. Let the scanner discover the retests of massive ranges so you aren’t shopping for into skinny air. - NVDA and AMZN

Large liquid leaders that respect assist and resistance and entice establishments. Nice for degree primarily based swing trades. - PLTR

Story inventory that usually reacts arduous at apparent ranges. Clear assist and resistance can preserve you sane by way of the noise.

By combining robust AI narratives with clear ranges and a devoted assist and resistance scanner, you set your self in a significantly better spot than the common dealer who’s simply reacting to headlines.

You recognize the story, you realize the degrees, and you’ve got alerts and scans working within the background. That’s the way you flip huge AI themes into precise trades you may handle.