AIZ broke a brand new document excessive to proceed the all-time bullish cycle. This current break makes probably the most worthwhile in its sector. Merchants ought to proceed to purchase the dip simply as we did from the blue field within the final replace.

About AIZ

Assurant Inc. (NYSE: AIZ) is a number one international supplier of threat administration and insurance coverage options, serving the housing and life-style markets. Headquartered in Atlanta, it operates throughout International Housing and International Way of life segments, providing merchandise similar to cell system safety, automobile service contracts, and renters insurance coverage. With operations in over 20 nations, Assurant companions with main monetary establishments and retailers, leveraging data-driven innovation to ship constant progress and powerful shareholder worth.

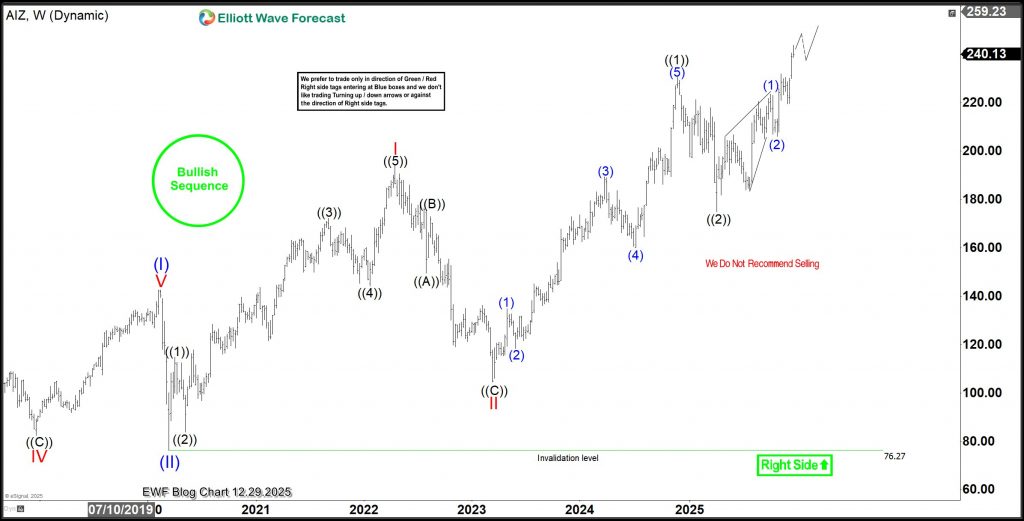

AIZ Lengthy Time period Elliott Wave Evaluation – Weekly Chart

The all-time bullish cycle for AIZ started in November 2008 at $12.52. From that low, wave (I) superior in a transparent impulse and peaked in February 2020 at $146.21. It was adopted by a pointy correction. Wave (II) led to March 2020 at $76.26. From there, wave (III) is anticipated to increase greater, with an total goal between $287 and $417. Between March 2020 and April 2022, value accomplished one other impulse. This transfer shaped wave I of (III). After that, a 7-swing pullback shaped wave ((2)). Patrons appeared within the blue field on the every day chart as proven within the seventh December replace. With wave ((2)) full, value resumed greater and broke above the wave (1) excessive first after which later wave ((1)) excessive. Consequently, wave ((3)) is now underway. This wave can goal the $330–$380 space over the approaching weeks or months.

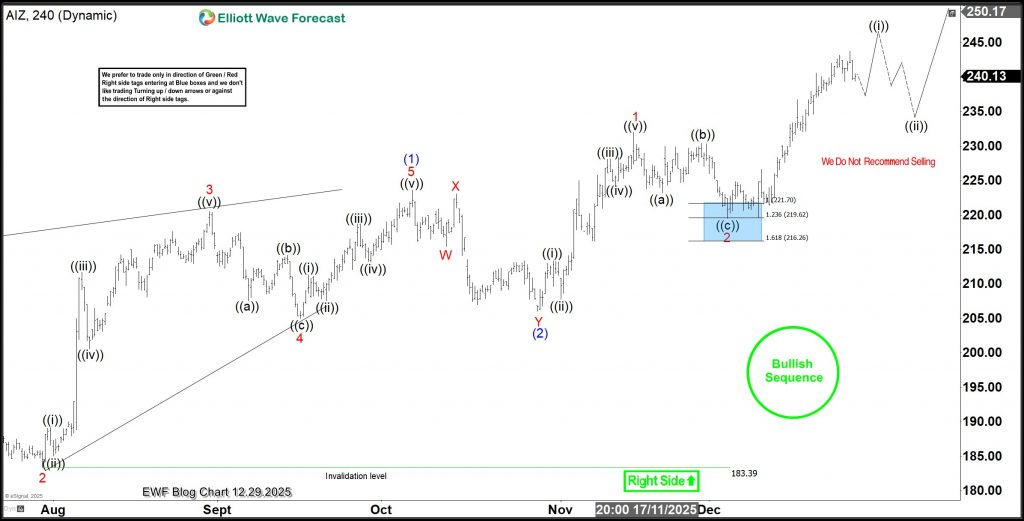

AIZ Commerce Setup –seventh December 2025

On seventh December, we shared the chart above. The chart reveals the standing of the pullback that adopted shortly after value breached the highest of wave (1) of ((3)). The pullback was for wave 2 of (3) and had simply accomplished a 3-swing construction on the blue field. Thus, we advisable to readers to go lengthy from the blue field.

AIZ Commerce Setup –14th December 2025

The chart above reveals a swift response from the blue field as anticipated. With this transfer, merchants closed half of the place in revenue after which set relaxation to breakeven. In a great value motion, Waves 3 lengthen to 1.618 x wave 1. On this case, we will anticipate wave 3 extending to $262. After this replace, the inventory broke upside within the subsequent hours to ascertain wave 3 even stronger. The chart beneath reveals the final chart and what we will count on subsequent.

AIZ Commerce Setup –twenty ninth December 2025

The rally from the blue field seems robust with no important pullback. Thus, the anticipation for an prolonged wave 3 which may surpass the $260 goal. Subsequently, I labelled it as wave ((i)) of three which nonetheless wants yet one more leg no less than, earlier than completion. At any time when it finishes, a pullback will emerge for wave ((ii)) which will likely be engaging to patrons from the blue field. In a bullish sequence, patrons ought to take lengthy positions from the dip. We offer pattern evaluation and sequence report for 78 devices on all main time frames for our members. As well as, we offer the zone to purchase or promote from.

Supply: https://elliottwave-forecast.com/stock-market/aiz-analysis-10-rally-blue-box/